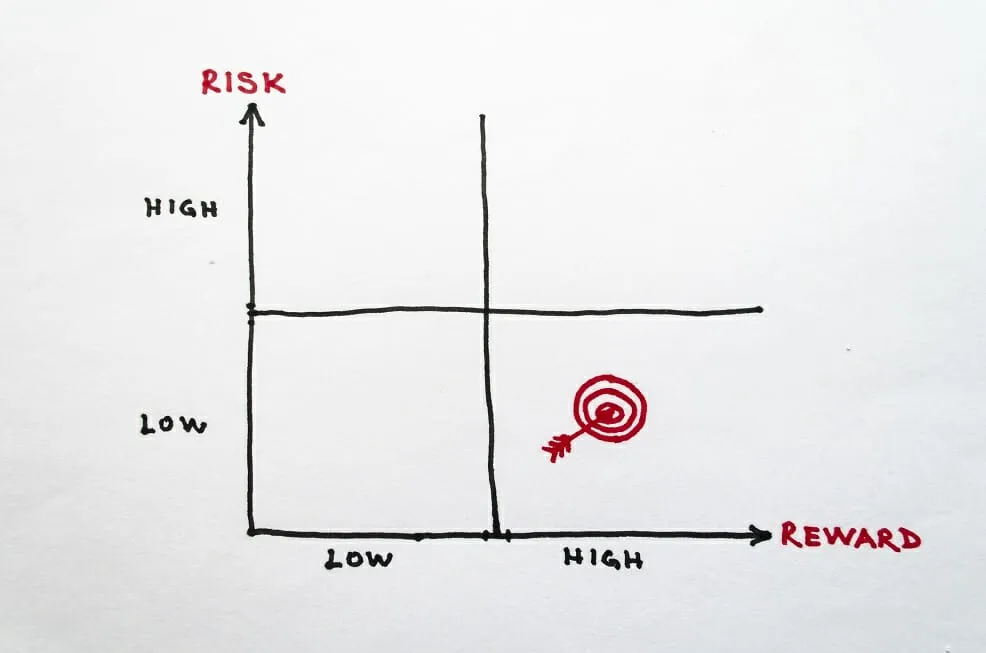

If you’re unsure which type of investment to make, it helps to know the risks associated with each type. These risks are usually the same across all types of investments. The highest risks involve stocks, which are not suitable for every investor. Listed stocks can be risky, as they can decrease in value quickly. However, shares offer a higher rate of return than debt. This is why stocks are more appropriate for those who want to maximize their returns.

While many high-risk investments are advertised as having high returns, they are not suitable for new investors. Only experienced investors should make such investments. They should be aware of the risks and be prepared to lose all the money they invest. While high-risk investments can provide higher returns, you should be prepared to lose all of your money if they do not perform. In many cases, high-risk investments are the best options for experienced investors with enough funds to absorb the risks.

Investing is risky in any form. While diversification can help minimize the risk of losses, it cannot guarantee a profit. For example, investing in bonds involves risk of interest rates, credit risk, and inflation. Foreign investments, on the other hand, are subject to currency risk and can be a risky proposition. But even if you choose to diversify your investments across different kinds of investment, it still has risks.

Bonds are riskier than stocks, but are also less expensive. They are considered a low-risk option compared to stocks. Bonds are debt investments, and their value will increase as the economy grows. Bonds usually have lower returns than stocks. They’re also known as junk bonds. A low-risk option, they’re still much better than losing money in stocks. If a company goes out of business or declares bankruptcy, it will pay bondholders first.

Another type of investment with the highest risk is private equity. These investments are created by private companies to raise capital. However, the returns from private equity investments are highly uncertain. Only invest in these investments if you can afford to lose all of your investment. They may also require holding for a long time and offer no guarantees of a positive return. If you’re not sure whether these investments are right for you, check with a financial advisor.

When it comes to investing, diversification is key. Diversification of investments will lessen the fluctuation in investment returns. For example, investing heavily in your employer’s stock, individual stock, and company stocks can pose a significant risk. By diversifying your investments, you will lower your chances of experiencing significant losses. The same principle applies to the Federal Reserve and stocks. For the most part, diversification is the best strategy.

Among the types of investment with the highest risk, equities are the primary asset in most accounts. Investors looking for moderate growth may seek to balance the potential risk with a higher return. They may choose higher-risk strategies to achieve significant growth. Those with longer time horizons may opt for aggressive growth strategies. Lastly, traders and speculators are seeking to maximize returns by using a variety of investment strategies, but they risk significant losses of principal.